STBL Tokenomics Unveiled: All You Need to Know

STBL has released full details of its tokenomics, outlining supply, allocations, vesting schedules, governance roles, and utility within its programmable finance protocol.

Miracle Nwokwu

January 8, 2026

Table of Contents

STBL, a protocol focused on programmable finance, has officially disclosed the tokenomics structure for its native token, $STBL. The release offers stakeholders a clear view of how the token operates within the ecosystem.

This move marks the team's commitment to transparency, especially as the project advances toward greater institutional adoption and scalability.

What Is STBL?

STBL serves as infrastructure for what the team describes as the next phase of stablecoins. At its core, the protocol enables the creation of Ecosystem Specific Stablecoins through a model called Money as a Service. This allows various networks and communities to issue their own stablecoins backed by real-world assets, such as tokenized money-market funds.

The system's flagship stablecoin, USST, is designed to maintain a dollar peg while separating the principal from the yield. Users deposit yield-bearing assets to mint USST for liquidity needs and receive a non-fungible token called YLD, which captures the accruing interest without requiring staking or lockups.

This approach aims to bridge traditional finance with decentralized systems, emphasizing regulatory alignment, on-chain transparency, and automated stability mechanisms. Founded by a team with experience in blockchain and finance, STBL positions itself to support institutions and ecosystems in managing programmable money at scale.

Total Supply and Initial Circulation

The STBL token has a fixed maximum supply of 10 billion tokens. At the token generation event, roughly 700 million tokens entered circulation, accounting for about 7% of the total supply.

This initial release was structured to support early liquidity and operations while reserving the majority for gradual distribution tied to project milestones and contributions.

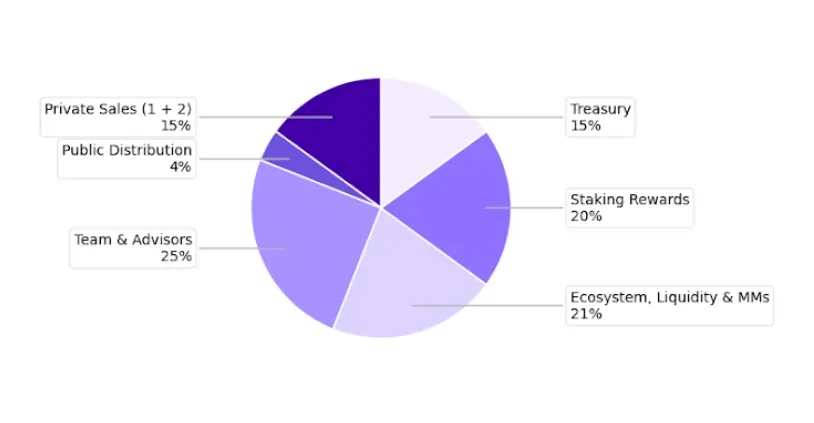

How is the Token Allocated?

The token supply breaks down into several categories, each with specific purposes to balance growth, incentives, and sustainability.

- The foundation allocation claims 25%, or 2.5 billion tokens, split between treasury management (15%, 1.5 billion tokens) for strategic funding and liquidity provision (10%, 1 billion tokens) to facilitate market making.

- Core development takes 36%, or 3.6 billion tokens, including 20% (2 billion) for the team, 5% (500 million) for advisors, and 11% (1.1 billion) for ecosystem expansion like partnerships and developer grants.

- Staking rewards hold 20%, or 2 billion tokens, to encourage participation in securing the network.

- Private sales account for 15%, or 1.5 billion tokens, divided between earlier rounds (12%, 1.2 billion) and a later one (3%, 300 million).

- Finally, community distribution gets 4%, or 400 million tokens, aimed at public sales to broaden access.

Vesting Schedules

To align incentives and prevent rapid supply increases, most allocations follow vesting periods. Treasury funds release 45% at launch, with the rest vesting linearly over 12 months. Liquidity tokens start with 4% available immediately, followed by monthly releases over a year.

Team and advisor portions include a 12-month cliff, after which 5% unlocks and the remainder vests linearly over 18 months, ensuring ongoing dedication. Ecosystem development begins with 10% at the start and vests over 12 months.

Staking rewards have a six-month cliff before 18-month linear distribution. Private sale 1 mirrors the team schedule with a 12-month cliff and 18-month vesting, while private sale 2 has a six-month cliff and 12-month vesting. Community tokens vest over six months after a three-month cliff.

Notably, the team has stated that even as some tokens vest, none will enter circulation in December 2025 or the first quarter of 2026, maintaining zero incremental supply and avoiding potential market pressure during this period.

Token Utilities and Governance

Beyond supply mechanics, the STBL token plays multiple roles in the protocol. Holders can participate in governance, voting on decisions like collateral types, fee adjustments, and upgrades, which fosters community-driven evolution.

As the system progresses, tokens will also stake to secure the network in its app-chain phase. Revenue from USST minting and burning fees, along with YLD protocol charges, feeds into an on-chain treasury. These funds support value-accruing features, such as Multi-Factor Staking, where users lock STBL alongside USST for rewards, promoting long-term holding.

Premium Buybacks use treasury revenue to repurchase and burn tokens above market rates, introducing deflationary elements that could enhance scarcity as adoption grows. This setup creates a cycle where increased stablecoin usage generates more fees, which in turn benefit token holders through burns and incentives.

Final Thoughts…

Late in December 2025, STBL announced a snapshot for the second month of community rewards based on contributions tracked via the Kaito leaderboard, with claims set to open soon for the top 200 participants.

Having earlier published the audit report for USST, the team also unveiled a brand refresh, aligning with the protocol's shift toward production-scale operations. These elements collectively paint a picture of a protocol methodically building toward broader utility.

As STBL continues to integrate real-world assets and expand partnerships, the tokenomics framework provides a foundation for stakeholders to engage with confidence.

Sources:

Read Next...

Frequently Asked Questions

What is the total supply of the STBL token?

STBL has a fixed maximum supply of 10 billion tokens, with approximately 700 million in circulation at the token generation event.

How is STBL different from traditional stablecoin protocols?

STBL enables Ecosystem Specific Stablecoins through a Money as a Service model, separating stablecoin liquidity from yield via USST and YLD NFTs.

What stablecoin does the STBL protocol currently support?

The protocol’s flagship stablecoin is USST, a dollar-pegged asset backed by yield-bearing real-world assets such as tokenized money-market funds.

What are the main utilities of the STBL token?

STBL is used for governance voting, staking to secure the network, treasury-backed incentives, and deflationary buybacks funded by protocol revenue.

Author

Miracle Nwokwu

Miracle NwokwuMiracle holds undergraduate degrees in French and Marketing Analytics and has been researching cryptocurrency and blockchain technology since 2016. He specializes in technical analysis and on-chain analytics, and has taught formal technical analysis courses. His written work has been featured across multiple crypto publications including The Capital, CryptoTVPlus, and Bitville, in addition to BSCN.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens