Attention Economy: How StayLoud.io Pays Users for Social Media Posts

StayLoud.io rewards X users with SOL for social media engagement. Learn how to trade $LOUD on Jupiter Exchange, earn weekly rewards, and participate in this Solana-based SocialFi experiment.

Crypto Rich

June 18, 2025

Table of Contents

Can your social media posts become a crypto goldmine? StayLoud.io suggests they can, and the results might surprise you. This Solana-based platform rewards users for generating engagement around its $LOUD token through posts on X (formerly Twitter). When @0x_ultra launched the project on May 31, 2025, it represented something entirely new in the SocialFi space – an experiment that turns attention into tradable value.

Here's how it works: Kaito AI measures social influence while the system distributes weekly SOL rewards from trading fees. Meanwhile, tokens trade on Jupiter Exchange, Solana's leading decentralized exchange aggregator. This article examines the mechanics, trading dynamics, and what this could mean for the emerging attention economy.

StayLoud.io: A New Take on Social Finance

This SocialFi experiment does something different – it monetizes social media attention directly. While traditional cryptocurrencies focus on utility or governance, $LOUD exists purely to drive speculation and engagement. At its core, the mission centers on converting social mindshare into measurable financial rewards.

Rather than a typical token sale, the project launched through an Initial Attention Offering (IAO) via HoloLaunch. This approach raised 400 SOL for 45% of the token supply, reflecting an unconventional focus on attention rather than traditional funding metrics.

These partnerships enable the platform's core functionality. Kaito AI provides the analytics to track social engagement, while Jupiter Exchange is the primary trading venue. Together, these integrations create a seamless pipeline from social posting to token trading.

How StayLoud.io Works: From Posts to Profits

User Participation Process

Getting started requires connecting both a Solana wallet and an X account to the system. Users then post content about $LOUD tokens on X, generating what the platform calls "mindshare." Kaito AI's analytics system tracks this engagement through sophisticated metrics, including likes, retweets, and follower quality.

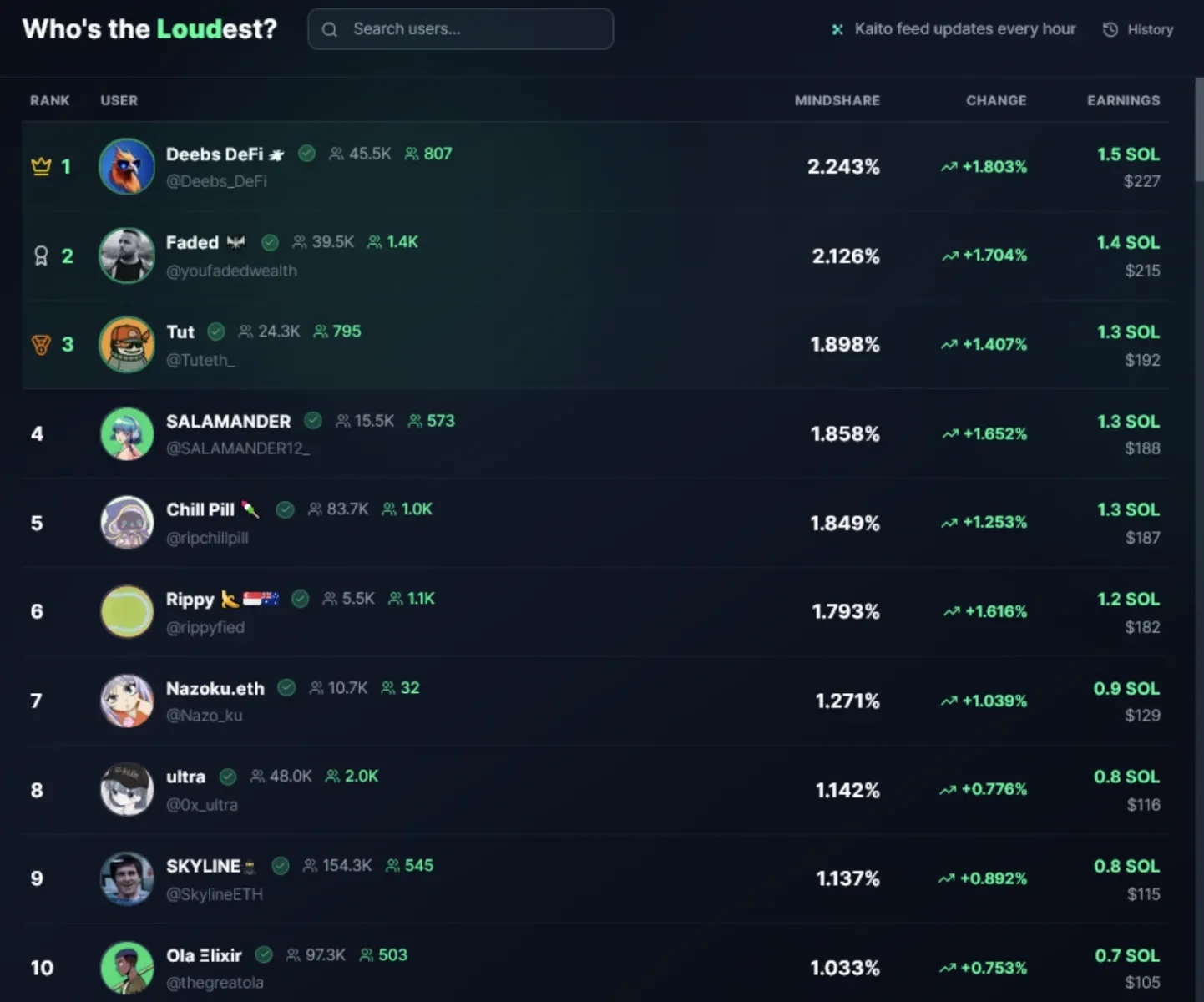

Every hour, the system updates user rankings based on their social influence. Each week, the top 25 contributors, known as "yappers," receive SOL rewards directly to their registered Solana wallets. No complicated claim process exists – rewards simply arrive automatically.

Fee Distribution System

Revenue comes from a 4% fee on all $LOUD token swaps, redistributed weekly according to a specific formula:

- 72% flows to the top 25 yappers based on Kaito AI rankings

- 18% goes to sKAITO stakers

- 10% returns to the project creator

Round 2 results were announced on June 15, 2025, with payouts following shortly after. This creates immediate financial incentives for social media engagement.

Initial Attention Offering Structure

The IAO process included multiple phases, with an interesting twist for fairness. Phase 2 participants received 0.15 SOL refunds by June 3, 2025, addressing oversubscription issues and ensuring fair distribution among early supporters.

$LOUD Token Trading on Jupiter Exchange

Exchange Integration

Jupiter Exchange is the primary trading venue for $LOUD tokens, and there's good reason for this choice. As a DEX aggregator, Jupiter optimizes swaps by sourcing liquidity from multiple pools across the network. This means traders get better prices and lower slippage compared to single-pool trading.

The system aggregates liquidity from Meteora DEX, where $LOUD maintains its primary trading pairs. Popular wallets like Phantom integrate directly with Jupiter, creating a smooth trading experience.

Current Market Data

As of June 17, 2025, $LOUD token shows the kind of volatility you'd expect from an attention-based asset:

- Price: $0.001244 (CoinMarketCap, down 90.02%)

- Market Cap: $1.24 million

- 24-Hour Trading Volume: $2.77 million (up 29.06%)

- Circulating Supply: 999.99 million tokens

- Total Supply: 999.99 million tokens

- CMC Ranking: #3316

Trading Pairs and Liquidity

$LOUD trades on multiple exchanges, with the most active being LBank, where the LOUD/USDT pair shows $1,669,946 in 24-hour volume according to CoinGecko. Other exchanges include BitMart and KCEX. On Jupiter Exchange, the token primarily trades in:

- $LOUD/SOL: The main trading pair with liquidity sourced from Meteora

- $LOUD/USDT: Alternative pairing for stablecoin traders

Liquidity data presents a complex picture. While early reports showed $LOUD/SOL liquidity challenges, Jupiter's aggregated data suggests higher liquidity pools in the $101,000-$120,000 range. Jupiter's aggregation system pools multiple sources, providing better trading conditions than single exchanges alone.

Trading Challenges

Several structural issues complicate $LOUD trading, and users have been vocal about them. The 4% swap fee is particularly high for Solana-based tokens, potentially deterring frequent traders. X posts from users consistently highlight this concern, noting that such fee structures may limit volume growth over time.

Supply concerns add another layer of complexity. Key influencers have avoided $LOUD due to lingering questions about token distribution and long-term value proposition. With limited utility beyond speculation, the project faces ongoing challenges in attracting sustained participation from major content creators.

Technology Stack: AI Analytics and Blockchain Infrastructure

Kaito AI Integration

At the heart of StayLoud.io sits Kaito AI, which powers the core functionality through natural language processing and social media analytics. The system tracks mindshare by analyzing engagement patterns, follower quality, and content relevance – then feeds this data into hourly ranking updates that determine weekly reward distributions.

However, the AI system faces serious challenges with gaming and fairness. Some top yappers have discovered they can post low-value engagement bait to artificially inflate their rankings. Project creator @0x_ultra has acknowledged these fundamental leaderboard issues and announced plans for significant algorithm tweaks. This transparent approach to addressing problems demonstrates responsiveness to community concerns. Such openness could strengthen user trust in the platform's development.

Solana Blockchain Benefits

Solana's high-speed, low-cost transaction processing makes it an ideal foundation for frequent trading and micropayments. The system leverages these capabilities for seamless reward distribution and token swaps, while the blockchain's scalability supports processing numerous small transactions efficiently.

Jupiter enhances this infrastructure by aggregating multiple DEX sources, providing better execution for $LOUD trades while maintaining Solana's speed advantages. The combination creates an efficient trading environment despite the experimental nature of the underlying token.

Market Reception and Community Response

Pre-Launch Momentum

Before its official launch, $LOUD captured 69% of tracked mindshare in its category, outpacing established projects like OpenSea. This attention translated into strong initial interest and successful IAO completion. The pre-launch buzz demonstrated the appeal of attention-based tokenomics.

Social media engagement remained high through the launch period, with users actively discussing strategies for earning rewards. The platform's official accounts built substantial followings during this phase.

Post-Launch Reality

Market sentiment shifted following the token's trading debut. Post-launch volatility and high fees sparked skepticism about long-term sustainability. X posts increasingly questioned $LOUD's lack of utility beyond speculation and attention generation.

Critics argue that without additional functionality, $LOUD may struggle to maintain value. Some community members have called for added features like staking mechanisms or governance rights to stabilize the token's purpose beyond pure speculation.

Copycat Emergence

StayLoud.io's influence spawned imitators, including YAPYO on Arbitrum. While this copying validates the original concept's appeal, it raises concerns about market fragmentation and the platform's competitive moat. The emergence of alternatives may dilute attention and trading volume.

Risk Analysis and Critical Assessment

Speculative Risk Factors

$LOUD token carries substantial risks. Its value depends entirely on trading volume and sustained social media attention. Unlike traditional cryptocurrencies with utility functions, $LOUD offers no fundamental value beyond market speculation.

Traders face exposure to extreme price swings and potential total loss. The project's novel nature means that precedent for success is limited. Market conditions could quickly shift attention to newer projects, leaving token holders with worthless assets.

Lower-Risk Participation

Yappers and sKAITO stakers face significantly lower financial risk. These participants can earn SOL rewards with minimal investment beyond time and social media effort. The risk-reward profile favors content creators over token speculators.

Weekly SOL distributions provide regular income opportunities regardless of $LOUD's price performance. This structure creates sustainable participation incentives for the most important user group: content creators driving platform engagement.

Sustainability Concerns

The platform's long-term viability depends on perpetual engagement growth. X posts note structural challenges, including high trading fees and limited influencer participation. Without continuous user and trading volume growth, the reward pool may become insufficient to maintain creator interest.

Algorithm fairness presents ongoing challenges. The current system's susceptibility to engagement manipulation could undermine reward distribution equity. Without continuous refinement, top earners may game the system rather than create valuable content.

StayLoud.io's Position in the InfoFi Landscape

InfoFi Category Definition

StayLoud.io pioneers the InfoFi (Information Finance) space, which monetizes attention and information sharing. This emerging category includes projects like Noise.xyz and Kaito's Yaps program. These platforms attempt to create financial value from social media engagement and content creation.

The "3,3 model" balances incentives across three participant groups: yappers (content creators), stakers (token holders), and speculators (traders). This structure aims to create sustainable engagement loops where each group benefits from others' participation.

Competitive Landscape

Within InfoFi, StayLoud.io differentiates through its AI-powered ranking system and direct SOL rewards. Competitors often use native tokens for rewards, creating additional volatility exposure. StayLoud.io's SOL distribution provides a more stable value for participants.

Jupiter Exchange's role enhances competitive positioning by improving $LOUD's accessibility. The aggregator's optimization capabilities make trading more efficient compared to single-DEX alternatives. This infrastructure advantage could prove significant as InfoFi projects compete for user attention.

Evolution Potential

Future development may address current limitations through enhanced functionality. Potential upgrades could include governance rights, staking mechanisms, or utility features beyond pure speculation. Such additions might stabilize token value and attract longer-term holders.

The system continues evolving based on user feedback and market conditions. Success metrics will likely focus on sustained engagement rather than traditional financial performance indicators.

Conclusion: Attention Economy Experiment

StayLoud.io represents a bold experiment in monetizing social media attention through blockchain technology. Jupiter Exchange integration provides accessible trading for $LOUD tokens, while Kaito AI creates measurable value from online engagement. This combination offers a new model for converting influence into financial rewards.

The project faces significant challenges, including speculative risks, sustainability questions, and algorithm fairness issues. High trading fees and limited utility may constrain long-term growth. However, the low-risk reward structure for content creators provides sustainable participation incentives.

Whether this approach proves sustainable remains an open question that will shape the InfoFi category's future. Success could influence the broader development of attention-based economies in Web3.

Visit StayLoud.io to connect your wallet and X account. Follow @StayLoudio and @KaitoAI on X for updates.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens