How Will Ripple’s DFSA License Impact UAE’s Cross-Border Payments?

With Dubai emerging as a global fintech hub, this license allows Ripple to tap into the region’s $40 billion cross-border payments market, which has seen rising demand for faster, cheaper, and more transparent transactions.

Soumen Datta

March 13, 2025

Table of Contents

Ripple has become the first blockchain-powered payment provider to secure approval from the Dubai Financial Services Authority (DFSA). This approval will allow Ripple to offer regulated crypto payments and services within the Dubai International Financial Centre (DIFC), a prestigious financial hub in the UAE.

Ripple has secured regulatory approval from the Dubai Financial Services Authority (DFSA), making us the first blockchain payments provider licensed in the DIFC. https://t.co/6oHWtnjODr

— Ripple (@Ripple) March 13, 2025

This milestone unlocks fully regulated cross-border crypto payments in the UAE, bringing…

With this milestone, Ripple has expanded its reach into a rapidly growing and highly influential market for cross-border payments, positioning itself as a major player in the region’s evolving digital financial landscape.

Ripple's Strategic Move into the Middle East

Ripple’s successful application to the DFSA marks its first regulatory approval in the Middle East. The UAE, particularly Dubai, has long been a supporter of fintech and blockchain innovation, making it an ideal location for Ripple to establish a deeper presence.

The UAE is home to a $400 billion international trade market, which has seen an increasing demand for efficient and cost-effective cross-border payment solutions. Ripple’s entry into the region opens the door for businesses in the UAE to leverage Ripple’s innovative payments technology, designed to address the challenges faced by traditional financial systems.

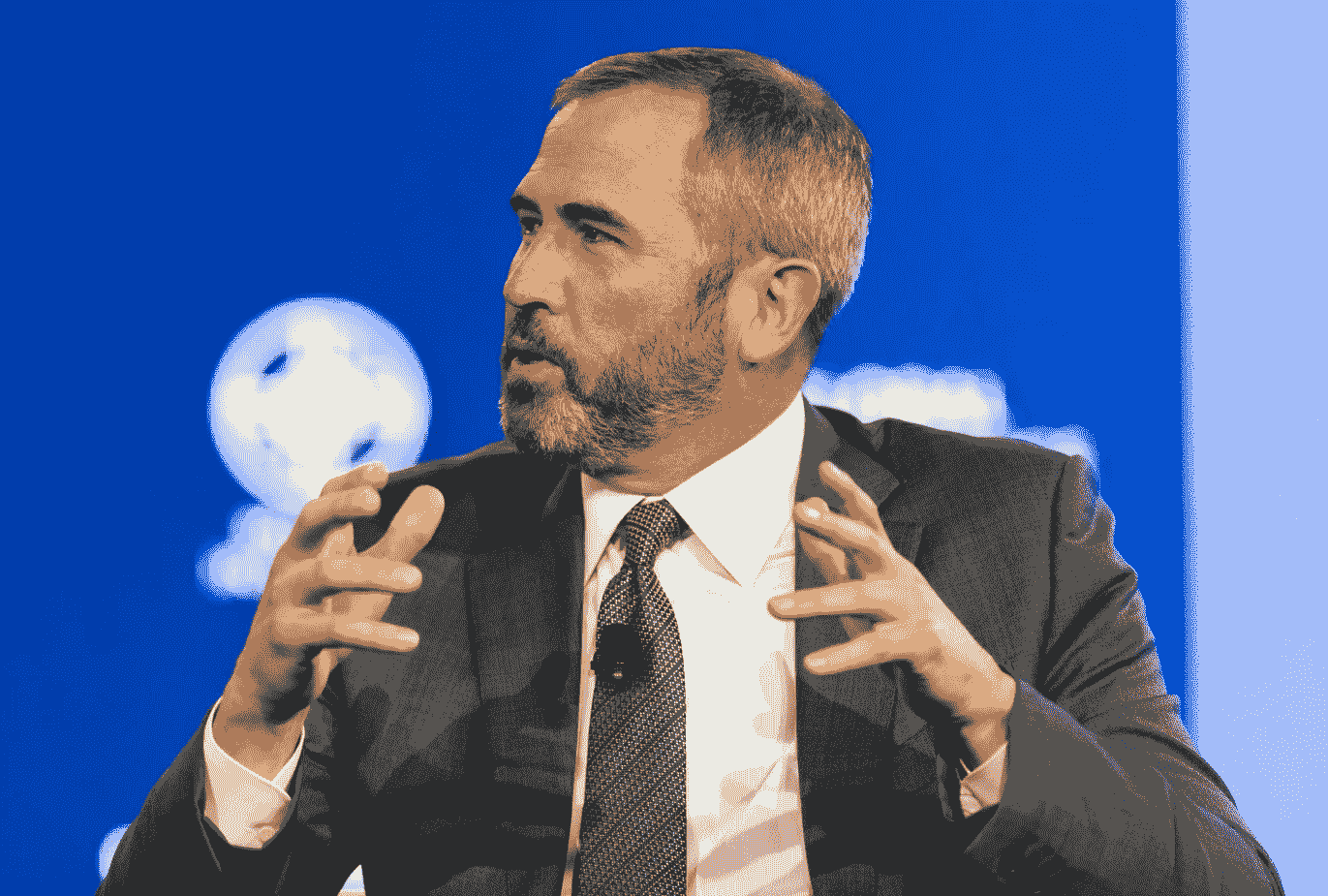

“We are entering an unprecedented period of growth for the crypto industry, driven by greater regulatory clarity around the world and increasing institutional adoption,” said Brad Garlinghouse, Chief Executive Officer of Ripple. “Thanks to its early leadership in creating a supportive environment for tech and crypto innovation, the UAE is exceptionally well-placed to benefit.”

Since establishing its Middle East headquarters in DIFC in 2020, Ripple has progressively deepened its engagement in the region.

With over 20% of Ripple’s global customer base already operating in the Middle East, this license positions the company to further enhance its footprint in the region.

As Reece Merrick, Ripple’s Managing Director for the Middle East and Africa, pointed out,

“Dubai and the broader UAE have established themselves as leaders in fostering a progressive and well-defined regulatory framework for digital assets. Securing this DFSA license is a major milestone that will enable us to better serve the growing demand for faster, cheaper and more transparent cross-border transactions in one of the world’s largest cross-border payments hubs.

Ripple’s DFSA license will allow it to cater to a growing demand for cross-border payment solutions and contribute to the UAE’s mission to become a global leader in blockchain adoption.

Ripple’s Role in Shaping Cross-Border Payments

Ripple’s entry into the UAE’s cross-border payments market is expected to tackle the inefficiencies plaguing traditional financial systems. High transaction fees, long settlement times, and lack of transparency have made cross-border payments a cumbersome process for businesses. Ripple’s technology promises to address these issues by enabling fast, transparent, and low-cost payments.

The UAE’s growing adoption of blockchain-based payment solutions is driven by the rising demand for faster, more efficient systems. According to a 2024 survey by Ripple, 64% of finance leaders in the Middle East and Africa (MEA) cited faster payment and settlement times as the most significant advantage of adopting blockchain-based currencies for cross-border payments.

Ripple’s suite of payment products, including the RLUSD stablecoin, is expected to revolutionize how payments are settled, offering real-time settlement, a stark contrast to the days-long processes associated with traditional banking systems. The RLUSD stablecoin, launched at the end of 2023, has already surpassed a $135 million market cap, indicating strong demand for blockchain-based solutions in the region.

Further, with the approval, Ripple can now offer its XRP Ledger (XRPL)-powered payment solutions to financial institutions across the UAE. This development strengthens Ripple’s role as a trusted partner for businesses and financial institutions seeking to leverage digital assets for real-world utility.

What Does the DFSA License Mean for Ripple and the UAE?

The DFSA is known for its progressive and transparent approach to crypto regulation, and Ripple’s entry into this market solidifies the UAE’s role as a hub for fintech and digital asset services.

Ripple’s approval from the DFSA grants the company the ability to operate within the DIFC and provide its compliance-first blockchain payments solutions to a host of financial institutions in the UAE. This marks a key moment for Ripple’s mission to revolutionize financial services by bringing the benefits of blockchain technology to the forefront of the global economy.

The UAE’s regulatory environment has consistently embraced innovation, which has helped attract global companies and startups to the region. As His Excellency Arif Amiri, CEO of DIFC Authority, stated,

“This milestone not only highlights our commitment to fostering innovation, but also opens the door for Ripple to tap into new growth opportunities across the region and beyond. As the Middle East, Africa and South Asia’s leading global financial centre, DIFC is proud to support forward-thinking companies like Ripple as they shape the future of finance and accelerate the adoption of blockchain technology in the payments industry.”

Ripple’s success in securing regulatory approval in the UAE is likely to encourage more traditional financial institutions and crypto-native firms to explore blockchain-based solutions for cross-border payments.

The approval adds to Ripple’s growing list of over 60 regulatory approvals worldwide, including from prominent bodies such as the Monetary Authority of Singapore (MAS) and the New York Department of Financial Services (NYDFS).

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Soumen Datta

Soumen DattaSoumen has been a crypto researcher since 2020 and holds a master’s in Physics. His writing and research has been published by publications such as CryptoSlate and DailyCoin, as well as BSCN. His areas of focus include Bitcoin, DeFi, and high-potential altcoins like Ethereum, Solana, XRP, and Chainlink. He combines analytical depth with journalistic clarity to deliver insights for both newcomers and seasoned crypto readers.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens