Crypto Czar David Sacks’ First Press Conference: Key Highlights

With bipartisan cooperation, a pro-crypto administration, and a clear regulatory roadmap, the U.S. may finally be on the path to becoming a global hub for digital assets.

Soumen Datta

February 5, 2025

Table of Contents

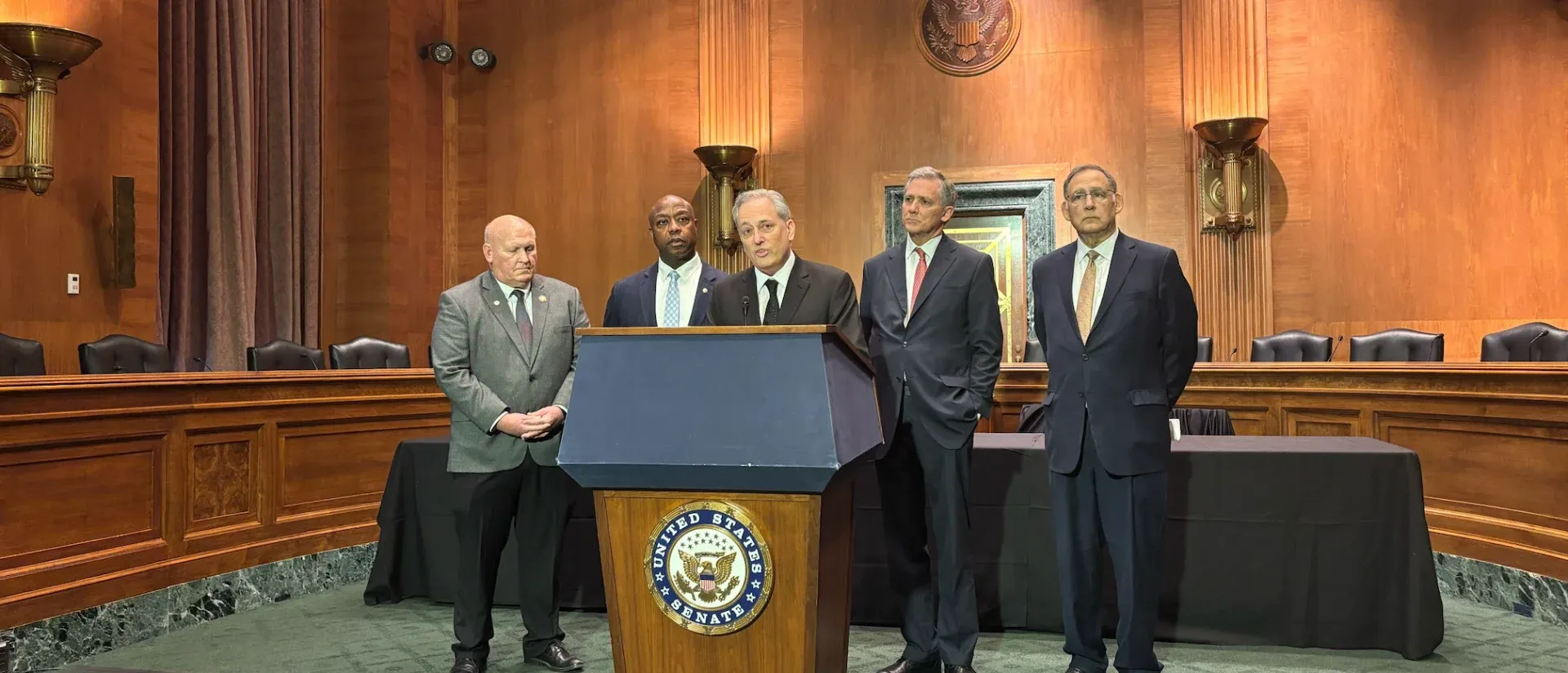

The U.S. government’s first-ever official press conference on digital assets on Feb. 4 marked a major shift in the country’s approach to crypto regulation. Led by David Sacks, the newly appointed Crypto Czar, and several pro-crypto politicians, the event set the stage for a more favorable regulatory landscape under the Trump administration.

Sacks emphasized the administration’s commitment to supporting Bitcoin, blockchain technology, and digital assets, signaling the beginning of what he called a "golden age" for crypto.

A Pro-Crypto Policy Under the Trump Administration

In his opening remarks, Sacks referenced President Trump’s executive order, which established a working group to draft a federal regulatory framework for digital assets.

“The President said in his executive order in the first week that it’s the policy of his administration to support the responsible growth and use of digital assets, blockchain technology and related technologies across all sectors of the economy.” Sacks stated.

For years, crypto businesses have faced regulatory uncertainty, with enforcement actions taken without clear guidelines. Sacks criticized the SEC’s aggressive approach under the previous administration, highlighting how startups were prosecuted without prior guidance and how founders were debanked for simply running crypto firms.

With a bipartisan coalition now working on crypto regulation, Sacks assured industry leaders that the focus will be on clarity and fairness rather than hostility.

A "Golden Age" for Bitcoin and Digital Assets

The most notable message from the press conference was the claim that crypto’s "golden age" has begun.

Senator Tim Scott reinforced this, saying: “The good news is that it’s going to get better.”

A joint working group has been established to drive crypto legislation, with members from the House and Senate.

The primary goal? Keeping innovation onshore. The administration aims to position the U.S. as a global leader in financial technology by stopping the exodus of crypto startups to other jurisdictions with clearer regulations.

Despite these ambitious promises, Bitcoin’s price dropped after the conference. Many investors had hoped for immediate, market-moving announcements, such as U.S. government Bitcoin purchases or tax incentives for digital asset holders.

A Unified Approach to Crypto Regulation

One of the most significant developments from the conference was the announcement of a bipartisan, bicameral working group dedicated to crypto legislation. This group includes:

House Financial Services Committee

Senate Banking Committee

House Agriculture Committee

Senate Agriculture Committee

By aligning multiple regulatory bodies, lawmakers hope to eliminate ambiguity over whether digital assets fall under SEC or CFTC jurisdiction. The plan is to streamline oversight and create consistent compliance guidelines for the industry.

This is a direct response to the previous administration’s fragmented regulatory approach, which left crypto businesses in legal limbo.

Stablecoins: Strengthening the U.S. Dollar in a Digital Economy

Stablecoins were another major focus of the conference. Lawmakers discussed how U.S.-regulated stablecoins could:

Enhance the dollar’s global dominance in digital finance

Drive demand for U.S. Treasuries, reducing interest rates

Provide a regulated alternative to offshore stablecoins

Senator Bill Hagerty introduced a new stablecoin bill, aligning with previous bipartisan efforts to create a clear legal framework for these assets. This initiative positions stablecoins as a key tool for global trade, cross-border payments, and decentralized finance (DeFi).

Ending Uncertainty for Crypto Entrepreneurs

For years, U.S. crypto founders have faced regulatory roadblocks, from debanking to surprise lawsuits. The administration’s new approach aims to:

Encourage domestic innovation by preventing startups from moving offshore

Separate legitimate projects from scams to prevent another FTX-like collapse

Provide clear compliance rules to avoid unnecessary enforcement actions

With defined legal structures, crypto firms can build confidently without fear of sudden regulatory crackdowns.

Key Legislative Priorities

Lawmakers are prioritizing two major crypto-focused bills:

Market Structure Legislation (Fit 21 Bill): Establishes clear definitions for digital assets, assigns regulatory oversight, and sets compliance standards.

Stablecoin Legislation: Expected to be fast-tracked in Congress, with bipartisan support ensuring a smooth passage.

The administration's proactive stance on regulation has fueled optimism that these bills will quickly move forward.

A U.S. Bitcoin Reserve? Exploring the Possibilities

One of the most intriguing revelations from the press conference was the discussion of a U.S. Bitcoin Reserve.

President Trump previously suggested that Bitcoin could be held as part of national reserves, and Sacks confirmed that the administration is actively studying this possibility. A Bitcoin Reserve could:

Diversify U.S. financial holdings in a digital-first economy

Strengthen America’s position in the global crypto market

Attract investment in blockchain infrastructure

Although no official commitment has been made, the fact that the idea is on the table signals a potential game-changer for Bitcoin.

What Could Have Been Better?

Despite the positive regulatory shift, some in the crypto community were disappointed by the lack of immediate policy changes. The press conference didn’t cover:

Confirmation of U.S. government Bitcoin purchases

Clarity on which digital assets will be part of the Treasury Reserve

Potential tax exemptions for crypto holders

While these topics were discussed, no concrete decisions were announced, leading to short-term market disappointment.

The U.S. stands at a defining moment for crypto policy. Over the next few months, lawmakers will:

Finalize crypto legislation

Educate new members of Congress on digital assets

Build a regulatory framework that protects consumers while fostering innovation

This period will determine whether the U.S. truly embraces financial technology leadership or falls behind. The administration's stance is clear:

"We don’t want to be behind in financial technology and digital assets. Our innovators need clarity." – Rep. French Hill

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Soumen Datta

Soumen DattaSoumen has been a crypto researcher since 2020 and holds a master’s in Physics. His writing and research has been published by publications such as CryptoSlate and DailyCoin, as well as BSCN. His areas of focus include Bitcoin, DeFi, and high-potential altcoins like Ethereum, Solana, XRP, and Chainlink. He combines analytical depth with journalistic clarity to deliver insights for both newcomers and seasoned crypto readers.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens