Could Robinhood’s U.S.-Only Election Market Predict Results Better by Excluding Foreign Influence?

Could Robinhood’s U.S.-Only Election Market Predict Results Better by Excluding Foreign Influence?

BSCN

October 28, 2024

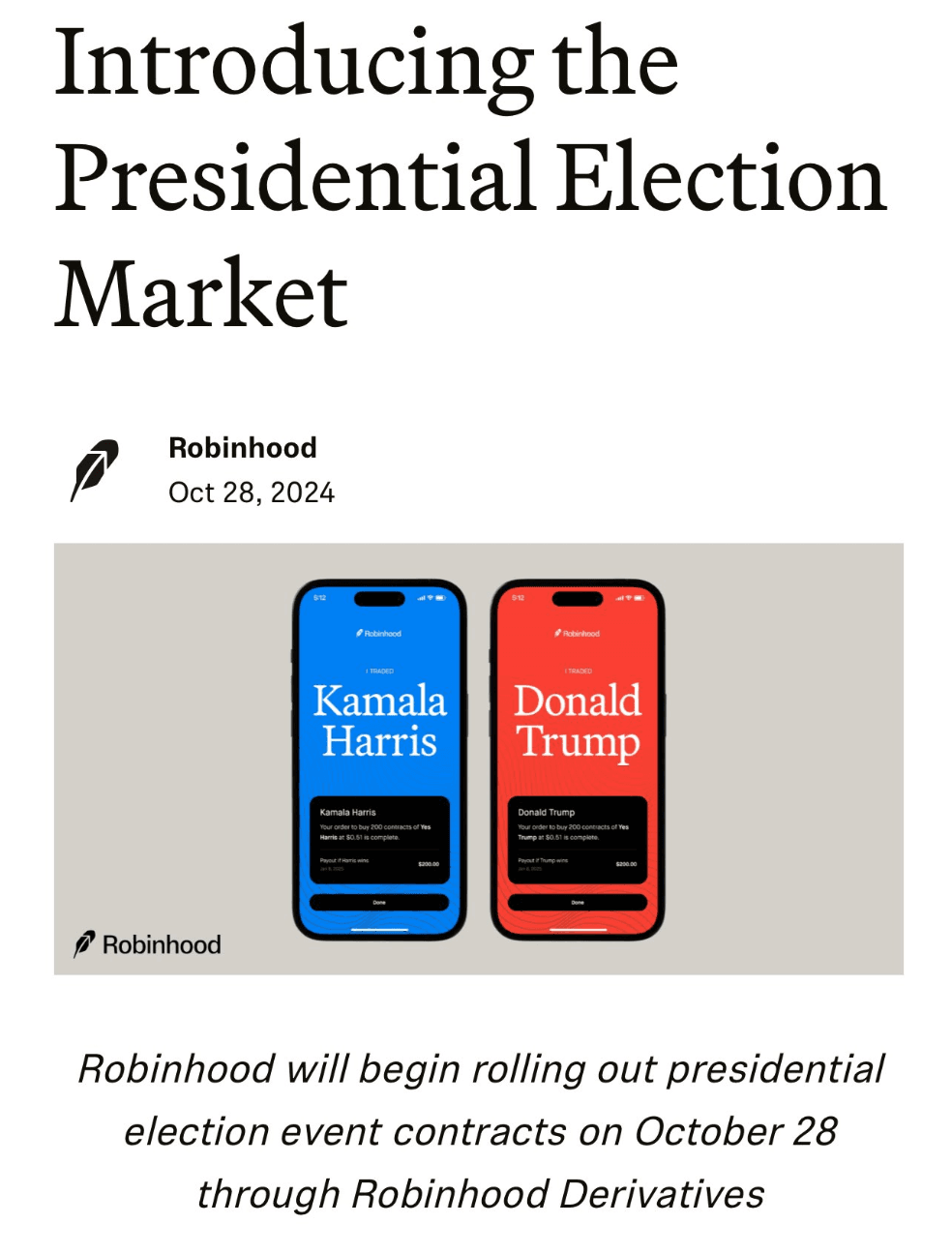

As the 2024 U.S. presidential election nears, a new player has entered the field of election prediction markets—Robinhood. The retail investing platform’s announcement of event contracts for the Trump versus Harris matchup has stirred fresh speculation over whether betting odds might serve as accurate indicators for election outcomes. The twist? Robinhood’s market is exclusive to U.S. citizens, a feature that could lend it more credibility than offshore platforms like Polymarket, which allow foreign investors to participate heavily. Could Robinhood’s U.S.-only market better predict the election by focusing solely on domestic sentiment?

Robinhood’s Entry and the Case for U.S.-Only Prediction Markets

Robinhood's U.S.-only election contracts, launched under the umbrella of Robinhood Derivatives, let users speculate on the likely winner, paying $1 per correct prediction for contracts priced according to market-implied probabilities. In contrast to platforms like Polymarket—which operates offshore and draws international investors—Robinhood’s restriction to U.S.-based participants eliminates the influence of foreign capital, theoretically focusing the prediction market on domestic voter sentiment. U.S. participants on Robinhood can wager up to 5,000 contracts on the outcome, potentially earning up to $5,000 per correct guess.

Robinhood’s move to offer these U.S.-only contracts comes amid renewed regulatory scrutiny. While platforms like Kalshi recently won a legal victory against the Commodity Futures Trading Commission (CFTC) over their ability to offer election bets, Robinhood’s U.S.-focused stance aligns with its regulatory requirements, potentially granting it more stability. Kalshi’s own election markets remain open to U.S. residents, but Polymarket’s offshore model and open access to non-U.S. bettors have created concerns about foreign influence potentially distorting market sentiment.

The Impact of Foreign Influence on Betting Accuracy

The question of whether foreign money impacts prediction market accuracy remains contentious. Polymarket, which permits international bettors, has seen significant foreign interest in Trump’s chances, with a French national reportedly placing nearly $30 million on a Trump victory. Critics like billionaire Mark Cuban have argued that heavy foreign betting activity on Polymarket could create a skewed picture, painting Trump as more favored than he may be among American voters. With Trump’s odds priced at approximately 62% on Polymarket—significantly higher than poll-based predictions that hover closer to 55%—the concern is that foreign investments may be driving up perceived support rather than reflecting the domestic electorate's preferences.

In contrast, Robinhood’s exclusion of foreign participants aims to offer a betting landscape more reflective of U.S. public opinion. By restricting contracts to American bettors only, Robinhood’s market potentially offers a purer gauge of national sentiment than platforms like Polymarket. This setup also addresses regulatory concerns about election integrity, a primary issue that has kept election betting markets contentious in the U.S.

Could U.S.-Only Markets Actually Predict Better?

Prediction markets can often provide valuable insights by aggregating collective wisdom. However, markets where most of the capital originates abroad may not accurately capture the nuances of the American voter base. By focusing exclusively on U.S. participants, Robinhood’s market may bypass the influence of international trends or biases, which could lend its odds more credibility as an election forecast tool.

However, even with foreign influence removed, prediction markets aren't foolproof. They remain susceptible to speculation and herd behavior, which can lead to inflated odds for popular candidates regardless of actual voter turnout projections. Nevertheless, by concentrating solely on domestic bettors, Robinhood’s model might provide a clearer, less distorted picture than those of its competitors, particularly in a high-stakes race where every point matters.

The Future of U.S.-Only Prediction Markets

Robinhood’s recent move to restrict election contracts to U.S. participants could herald a new approach for prediction markets, aligning them more closely with national sentiment and potentially enhancing their reliability as election indicators. Whether this U.S.-only approach will yield more accurate predictions remains an open question. But as Robinhood’s market gains traction among Americans, it offers a fascinating case study: could limiting election betting to domestic participants produce a prediction market more closely aligned with real outcomes?

Only time—and the results on Election Day—will reveal whether this model is a more accurate barometer of political sentiment than its foreign-influenced counterparts.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Latest News

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens

Latest Crypto News

Get up to date with the latest crypto news stories and events