CRO

A Look at MadMex: The All New Decentralized Perpetual Exchange From Mad Meerkat on Polygon

On overview of the newest Decentralized Perpetual Exchange From MMF: MadMex.

BSCN

September 11, 2022

MadMex looks to Maximize Capital Efficiency

Mad Meerkat Finance (MMF) launched a V3 Decentralized Exchange(DEX) known as MadMex, on Sept 3 to maximize capital efficiency while extending the number of features it offered earlier.

“The community has been largely receptive to MadMeX, as it provides a simple and efficient UI influenced by perps trading on CEXes, but now on DEXes,” Utan Boss, co-founder of MMF, told Web3Wire. “As we all know, bringing CEXes products to DeFi can be tricky because we are governed by smart contracts on DeFi, so this is an exciting decentralized dapp that is now on Polygon.”

1/ ⚡️ MadMex - the #1 Decentralized Leverage Exchange has just gone LIVE.

— MM.Finance - #1 Defi Ecosystem on #Polygon #Cronos (@MMFcrypto) September 3, 2022

3 ways to earn yields

1. 📈 Traders - Trade on our decentralized leverage exchange at up to 30x leverage and increase your payout massively if you can predict the market well - https://t.co/Tkm0UN268s pic.twitter.com/kK3XNZpcQJ

Currently, MadMex is only available on Polygon, but the co-founder hopes to bring it to Cronos soon.

“The issue with Cronos is that Chainlink isn't deployed there, and MadMex requires the use of Chainlink as a reliable price oracle,” Boss shared with Web3Wire. “However, we are in direct talks with the Cronos team on how we can bring over MadMeX to the Cronos side.”

As we wait for MadMex availability on Cronos, let's look at what we already have on Polygon.

Buy and Stake MLP

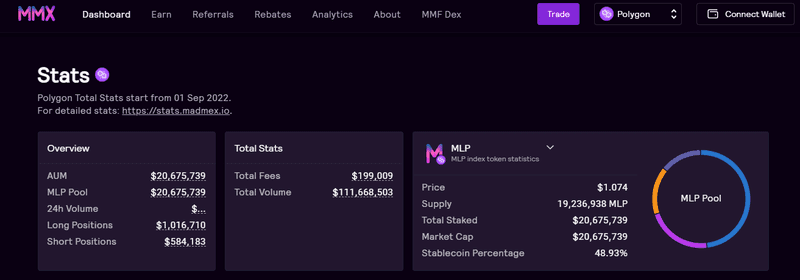

Upon entering the MadMex site, you will see various options at the top, along with some underlying statistics.

After connecting your wallet, you can choose the 'Earn' option and buy some MadMex Liquidity Provider (MLP) tokens. MLP tokens index four key crypto-currencies: Bitcoin, USDC, Ethereum, and MATIC. By accumulating trading fees, the token provides a hedged position for liquidity providers.

As described in the Medium article from Sept.2, MLP token holders receive 70% of the protocol profits. Additionally, the team affirmed that the MLP token's value would increase over time, and when that happens, you can redeem it for more index assets.

You can connect your wallet swap BTC, ETH, USDC, MATIC, and WMATIC for MLP.

Moreover, You can then stake those MLP tokens by going over to MMF DEX on Polygon.

Further, you can form MLP/USDC LP on MM DEX on Polygon and stake that LP there.

Leverage Trading for Experienced Traders

If you predict the market well, you can increase your payout by trading on MadMex decentralized leverage exchange at up to 30x leverage. To determine whether you should go long (buy) or short (sell), you must decide in which direction the market will go.

The trades page at the bottom also lets you monitor your positions.

You can take a profit anytime by closing your positions via the "Market" tab. Alternatively, you can choose a take profit level via the "Trigger." tab

Remember that you might lose your money if you were highly leveraged and the token's price didn't go as expected.

The risk of leverage trading stems from the fact that it magnifies your potential investment losses. You can even lose more money than you have available to invest in some cases. Traders with experience usually perform these type of trades.

Rebates in USDC

You can receive up to 50% trading fee rebates in the form of USDC when you stake MMF into the rebate funding wallet. However, if you qualify for the highest tier & have enabled deduction of MMF, you can receive 100% trading fee rebates in the form of USDC.

Weekly snapshots of trading fee rebates are taken on Wednesday (may vary by timezone), and rebates are distributed on Thursday. You can learn more about the rebates here.

Referrals

By referring your friends, you can earn up to 15% of their fees and receive a 10% discount on your fees. On the Affiliates tab, you can create a referral code using any combination of letters, numbers, and underscores.

In addition to these features, you can also check out the analytics page. The page contains charts and numbers about TVL, pool composition, MLP performance, price composition of MLP and more.

The MMF team will provide more updates about MadMex in upcoming days.

“MadMex will enable much better capital utilization flow than traditional V2 Dexes, and hence we are placing a prime focus on migrating most liquidity over to MadMeX through our unique v3 DEX value proposition,” Boss added.

Latest News

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens

Latest Crypto News

Get up to date with the latest crypto news stories and events